You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

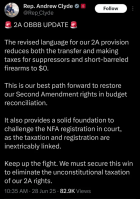

There Goes Our No Tax on Suppressors

- Thread starter timeout

- Start date

urbanrifleman

Site $$ Sponsor

Unfortunately I'm afraid reducing the tax to zero makes it super easy for gun grabbers in the future to make the tax 25k.

Considering that the ATF is a tax enforcement agency (supposedly a part of Treasury, but no one really knows anymore where they came from at all), why would they be involved at all if there is no tax?

urbanrifleman

Site $$ Sponsor

I see two paths-

1. They'll somehow defend it as a zero dollar tax

2. It goes to court because it's a defacto registry.

Or some combination of both.

Of course, the ATF is involved with every aspect of firearms, and their is no taxation in nearly every case. They just took control and no one pushed back.

urbanrifleman

Site $$ Sponsor

Thankfully Chevron Deference is shut down. Now someone just needs to do something about it.

Good point.

The question is, who is left to push back? The pro gun movement is all but destroyed from within. If there is a group of lawyers attacking the anti gun history, I've not seen them.

urbanrifleman

Site $$ Sponsor

Well, we know the NRA wont do jack diddly.

FPC is our best bet right now... unless bills get passed.

If Michael Collins Piper were still alive I would ask him to find out who infiltrated the NRA. There's a story there.

Honestly, while I don't like the tax, what I REALLY don't like is the registration. Specifically, I don't like having to 1.) Ask permission to acquire and then 2.) at least partially sign away my 4th amendment right in order to fully exercise my 2A rights. While the ATF is not "allowed" to have a gun registry, I highly doubt that any judge would ever uphold that with regards to Class III items. In my humble (and absolutely worthless) opinion, our BEST option is to leave the tax and then argue in court that a $200 tax on something that otherwise only costs $200-$600 (at least for the budget friendly options) is unconstitutional and has been since 1934 while also making the argument that the entire purpose of the 1938 Federal Firearms Act was to neuter the publics access to the exact types of "Arms" that the 2nd Amendment was intended to protect and for the exact reason(s) that the founding fathers put it into writing to begin with. It's sole purpose was and is to ensure that the ordinary citizen can not have access to "Arms" that would put them on level a level playing field with employees of the various government agencies. The federal government derived the authority to do this through its authority to regulate interstate commerce. In order to claim they were merely regulating commerce, they implemented the $200 tax stamp (which would be the equivalent of roughly $4,500 today). SCOTUS has consistently ruled that a tax can not be used as a means of preventing access to goods or services. Even at only $200 in today's economy, it hinders access. If it were +$4,500, it would be impossible for a sane person to logically defend the stamp, but again, the cost of the stamp is not the issue. The issue is that the federal government has been overstepping its authority (to regulate interstate commerce) and in doing so it has directly violated the exact purpose of the 2nd amendment.

Southern Democrats like Wayne LaPierre???If Michael Collins Piper were still alive I would ask him to find out who infiltrated the NRA. There's a story there.

It's not that I think any one side is actually, morally better than the other. As individual organizations, both sides have been trying to force the people to bend to their will for at least 150 years. Its one thing for an organization and/or its leadership to behave in a particular fashion. Its another thing entirely when the vast majority of the people who support that organization behave in that way, and that's exactly what has been happening with the Democratic party since the end of the Civil war (and technically before, although I'd also argue that the Northern Industrialists were just as guilty of supporting their own version of slavery).

One thing we would be wise to remember is that people who excel in government, by their very nature, expect everyone to follow rules (ie laws). Maybe they think the same rules apply to everyone, maybe they don't. Maybe the rules they want the citizens to follow happen to be good and just, or maybe they aren't. Regardless, rules are simply the words of men and as such they are incomplete and thus easily corruptible. Thus anyone who promotes the "Rule of Law" instead of right and wrong should not be trusted. The idea that we should follow a rule just because 600 people of low moral standard voted on it and 60% agreed it should be a law for over 340 million people to follow is absolutely ridiculous.

Last edited:

HandgunHTR

Gold $$ Contributor

Well, it passed the Senate and here is the exact language that was in the version that passed.

SEC. 70436. REDUCTION OF TRANSFER AND MANUFAC-14

TURING TAXES FOR CERTAIN DEVICES.15

(a) TRANSFER TAX.—Section 5811(a) is amended to16

read as follows:17

‘‘(a) RATE.—There shall be levied, collected, and paid18

on firearms transferred a tax at the rate of—19

‘‘(1) $200 for each firearm transferred in the20

case of a machinegun or a destructive device, and21

‘‘(2) $0 for any firearm transferred which is22

not described in paragraph (1).’’.23

(b) MAKING TAX.—Section 5821(a) is amended to24

read as follows:25

464

BAI25351 FR8 S.L.C.

‘‘(a) RATE.—There shall be levied, collected, and paid1

upon the making of a firearm a tax at the rate of—2

‘‘(1) $200 for each firearm made in the case of3

a machinegun or a destructive device, and4

‘‘(2) $0 for any firearm made which is not de-5

scribed in paragraph (1).’’.6

(c) CONFORMING AMENDMENT.—Section 4182(a) is7

amended by adding at the end the following: ‘‘For pur-8

poses of the preceding sentence, any firearm described in9

section 5811(a)(2) shall be deemed to be a firearm on10

which the tax provided by section 5811 has been paid.’’11

(d) EFFECTIVE DATE.—The amendments made by12

this section shall apply to calendar quarters beginning13

more than 90 days after the date of the enactment of this Act

The way that I read this is that the tax for transfer or making of a machinegun or a destructive device is still $200, but all others (suppressor, SBRs, SBS) are now $0.

SEC. 70436. REDUCTION OF TRANSFER AND MANUFAC-14

TURING TAXES FOR CERTAIN DEVICES.15

(a) TRANSFER TAX.—Section 5811(a) is amended to16

read as follows:17

‘‘(a) RATE.—There shall be levied, collected, and paid18

on firearms transferred a tax at the rate of—19

‘‘(1) $200 for each firearm transferred in the20

case of a machinegun or a destructive device, and21

‘‘(2) $0 for any firearm transferred which is22

not described in paragraph (1).’’.23

(b) MAKING TAX.—Section 5821(a) is amended to24

read as follows:25

464

BAI25351 FR8 S.L.C.

‘‘(a) RATE.—There shall be levied, collected, and paid1

upon the making of a firearm a tax at the rate of—2

‘‘(1) $200 for each firearm made in the case of3

a machinegun or a destructive device, and4

‘‘(2) $0 for any firearm made which is not de-5

scribed in paragraph (1).’’.6

(c) CONFORMING AMENDMENT.—Section 4182(a) is7

amended by adding at the end the following: ‘‘For pur-8

poses of the preceding sentence, any firearm described in9

section 5811(a)(2) shall be deemed to be a firearm on10

which the tax provided by section 5811 has been paid.’’11

(d) EFFECTIVE DATE.—The amendments made by12

this section shall apply to calendar quarters beginning13

more than 90 days after the date of the enactment of this Act

The way that I read this is that the tax for transfer or making of a machinegun or a destructive device is still $200, but all others (suppressor, SBRs, SBS) are now $0.

HandgunHTR

Gold $$ Contributor

“Making” is an interesting choice of a word… just seems out of place.

Making refers to actually making an Short-barreled rifle, shotgun, or making a suppressor.

Take an AR lower, put a pistol upper on it and you are "Making" a Short-Barreled rifle. In order to do that you have to 1) have an approved Form 1, which requires the payment of a $200 tax and 2) have the firearm portion of the gun (the lower) properly marked.

That is why "Making" is included in the language.

R.Morehouse

Gold $$ Contributor

Will suppressors be able to be sold over the counter without any sort of paperwork, like buying a set of rings or a pic. rail?

Regards

Rick

Regards

Rick

HandgunHTR

Gold $$ Contributor

Will suppressors be able to be sold over the counter without any sort of paperwork, like buying a set of rings or a pic. rail?

Regards

Rick

Not until they are removed from the NFA.

SteveOak

Gold $$ Contributor

The $200 tax on firearms suppressors was established in 1934 as part of the National Firearms Act (NFA).Taxes, in my opinion, should be reasonable. $200 is as much as 20-25% depending on the model. In some cases even more. That isn’t reasonable….

As an accessory, they shouldn’t be taxed any more than any other commercially sold item, nor should they be even classified the way they are.

They should work to end the $200 tax. Flat tax them on the federal level at 3%, remove them from the NFA, and sell them in front of the counter, not behind it, like every other commercially produced accessory.

In 1934 that was a considerable sum. That is like nearly $5,000 today.

Coyotefurharvester

Silver $$ Contributor

Almost laughable opposing a tax payment enacted by elected representatives, many of whom were/are funded politically by "supporters" of the 2nd amendment. Or simple terms, there are thousands of 2nd amendment constitutional supporters(democrats) contributing millions of dollars to elect individuals to legislate away the constitution. Democrats run on "gun control". I've known this since I was 20 and voted for Reagan. Follow the money, please stop funding democrats(NYC is a perfect example). Just saw a new gun control ad on AMC, likely the result of NGO tax money.

Similar threads

Upgrades & Donations

This Forum's expenses are primarily paid by member contributions. You can upgrade your Forum membership in seconds. Gold and Silver members get unlimited FREE classifieds for one year. Gold members can upload custom avatars.

Click Upgrade Membership Button ABOVE to get Gold or Silver Status.

You can also donate any amount, large or small, with the button below. Include your Forum Name in the PayPal Notes field.

To DONATE by CHECK, or make a recurring donation, CLICK HERE to learn how.

Click Upgrade Membership Button ABOVE to get Gold or Silver Status.

You can also donate any amount, large or small, with the button below. Include your Forum Name in the PayPal Notes field.

To DONATE by CHECK, or make a recurring donation, CLICK HERE to learn how.