Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

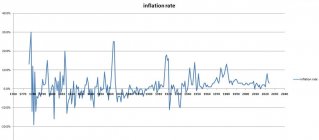

Price of Powder & Primers in Perspective

- Thread starter Forum Boss

- Start date

ronsatspokane

Gold $$ Contributor

So the thing about this that galls me is that many who voted in the last election and will in the next are calling necessary increases in prices (survival increases in some cases) on the part of manufacturers greed. The majority of people in this country have no idea what the process or cost of providing a product is. They sit on their thumbs and expect product to magically show up.One of the more unreported inflationary figures is the cost of doing business in the manufacturing industries.

At our Machine Shop, we have seen the cost of the bar stock that we use to make propellor shafts, rudder stocks, coupling blanks and not blanks from has gone up as much as 45% since Covid/Biden.

The cost of the stainless steel submerged arc welding wire we use has gone up on average 50% since Covid/Biden.

Tooling cost have gone up even more. So has the cost of insurance, labor, shipping, and just unlocking the doors and turning the lights on.

You rarely hear any news about this.

As for the old days, my wife and I bought our first “nice” house in 1976, we got a 9% VA Loan as considered ourselves lucky. We lived in that house for 47 years.

As for other interest rates, in 1982 we bought a new Cadillac Elderado and I can remember the salesman informing us of the great news, we could get GMAC financing at ONLY. 15%.

By the way, when we moved up to tomball 3 1/2 years ago, before everything went crazy, I got a VA loan for 3.2%.

Worse yet is yet another perspective. Over half of the people who voted in the last election voted for the current state of affairs. Either that or they were to stupid to understand the implications of their vote. Either way, it is a sobering truth. Think I'll drink to the dip shites.

ronsatspokane

Gold $$ Contributor

Half true. There are two types of inflation. One is demand based and is often referred to as demand pull. As in too much money chasing to few goods and services. The other type is cost based often referred to as cost push. As in limiting the supply of a good or service or increasing the cost of a good or service. Currently we are suffering from both. Government racking up debt in our name and flooding the economy with cash and the war on energy is driving up the cost of the most basic good in the economy. Then there is also auxiliary cost push in terms of adding regulations which increase the cost of doing business or limits the ability to do business.Look inflation up in the dictionary. It is defined as the government inflating the money supply, not rising prices. Rising prices is a result of the inflating of the money supply.

buck broyles

Silver $$ Contributor

Infrequent Shooter

Gold $$ Contributor

CEO pay has gone from 10-30 times the amount of the average worker up to approx 300 times. I call BS on that. Another big problem is our balance sheet. Eventually, our country's financial health will hurt us as a world power, It already is in many aspects. It will take 15 years to get our balance sheet back in order, but it can be done. and leaving gold standard was huge mistake. like giving the Govt. cocaine and money printers.

dryhumor

When an old man dies, a library is lost forever...

As wages rise, so do the billable charges. In 2004, our top hourly wage was $30 an hour. In 2010-2012 it rose to $36. Before I retired, the structure was split. One topped out at about $39, the other topped out at about $49.

The $39 rate bills out at $160 ish. The $49 rate bills out at $225 ish.

The consequences of that? Lost customers. Why pay that high rate, when you can get 90% of the skills and support to do the work for 50% of the cost through another vendor. Brand loyalty only goes so far.

Freight costs during and just after Covid reached the absolute stupid stage. What had been $800-1000, went to $2500 plus.

Want to buy American? Good luck, the global economy is a real thing. Our equipment had components from China, Mexico, USA, Germany, etc. I learned recently that some items are currently out 100 plus weeks lead time. Part of that is backlog of components, part of it is labor shortages.

And speaking of labor. The lack of skilled labor is a drag on the economy. For maybe 4 years before I retired, almost all of us in the field were older. Not so many younger workers even willing to show up, give a good days work, and pay their dues to gain the skills they needed to thrive and survive.

This country needs skilled labor for growth, not service or unskilled workers dependent on mostly disposable income to survive.

The $39 rate bills out at $160 ish. The $49 rate bills out at $225 ish.

The consequences of that? Lost customers. Why pay that high rate, when you can get 90% of the skills and support to do the work for 50% of the cost through another vendor. Brand loyalty only goes so far.

Freight costs during and just after Covid reached the absolute stupid stage. What had been $800-1000, went to $2500 plus.

Want to buy American? Good luck, the global economy is a real thing. Our equipment had components from China, Mexico, USA, Germany, etc. I learned recently that some items are currently out 100 plus weeks lead time. Part of that is backlog of components, part of it is labor shortages.

And speaking of labor. The lack of skilled labor is a drag on the economy. For maybe 4 years before I retired, almost all of us in the field were older. Not so many younger workers even willing to show up, give a good days work, and pay their dues to gain the skills they needed to thrive and survive.

This country needs skilled labor for growth, not service or unskilled workers dependent on mostly disposable income to survive.

Infrequent Shooter

Gold $$ Contributor

110%!!As wages rise, so do the billable charges. In 2004, our top hourly wage was $30 an hour. In 2010-2012 it rose to $36. Before I retired, the structure was split. One topped out at about $39, the other topped out at about $49.

The $39 rate bills out at $160 ish. The $49 rate bills out at $225 ish.

The consequences of that? Lost customers. Why pay that high rate, when you can get 90% of the skills and support to do the work for 50% of the cost through another vendor. Brand loyalty only goes so far.

Freight costs during and just after Covid reached the absolute stupid stage. What had been $800-1000, went to $2500 plus.

Want to buy American? Good luck, the global economy is a real thing. Our equipment had components from China, Mexico, USA, Germany, etc. I learned recently that some items are currently out 100 plus weeks lead time. Part of that is backlog of components, part of it is labor shortages.

And speaking of labor. The lack of skilled labor is a drag on the economy. For maybe 4 years before I retired, almost all of us in the field were older. Not so many younger workers even willing to show up, give a good days work, and pay their dues to gain the skills they needed to thrive and survive.

This country needs skilled labor for growth, not service or unskilled workers dependent on mostly disposable income to survive.

Inflation is simply the inflating of the money supply by the government, by definition.Half true. There are two types of inflation. One is demand based and is often referred to as demand pull. As in too much money chasing to few goods and services. The other type is cost based often referred to as cost push. As in limiting the supply of a good or service or increasing the cost of a good or service. Currently we are suffering from both. Government racking up debt in our name and flooding the economy with cash and the war on energy is driving up the cost of the most basic good in the economy. Then there is also auxiliary cost push in terms of adding regulations which increase the cost of doing business or limits the ability to do business.

Prices rise and fall for other reasons many of which you name.

Inflation always results in an increase in price.

br1111

Silver $$ Contributor

the democrats are sandbagging the inflation numbers because its an election year just like they did for the midterms. they really hurt millions of americans on social security because the cola raises were calculated on the democrats lies. they dont care who they hurt to stay in power. case in point look what they did to the border to get that voter base. I hope america wakes up!110%!!

Jayplace

Gold $$ Contributor

I too get concerned about uncertain times, but it isn't anything new. Before my time even, but don't forget the 30's and the Great Depression and the Housing crash of 2008-2009 which I remember. There have always been ups and downs. The two I mentioned are just a couple that most remember, but there have been many.Scary times for a child to have to grow up in. Did we grow up rich? Not at all but there was much less uncertainty back then. No one worried about an economic collapse or a correction which I feel will happen soon. Here I am 45 with another child on the way (wow). Back then the future seem much more solidified.

The most important factor in reducing these extremes is to have a government that is stable and rational. There are no quick fixes to change the economy. It's like a big ship, it takes time to make correction in its direction and it's always more complicated than it looks. There are many moving parts.

Currently we are still dealing with the chaos caused by Covid, but it's a lot better than I would have expected after having the nation largely shut down for several years.

Jayplace

Gold $$ Contributor

I would respectfully disagree. More petroleum products are already exported than imported. The oil industry has for years received more regulation breaks than any other industry. I understand different people have different feelings on this, but, as a whole we do need to do more to protect the environment and that will only be accomplished by regulations of some sort.Not necessarily. Should Trump end the war on energy and once again roll back regulations including DEI mandates, one of the primary cost drivers for for this inflation will be significantly reduced. Yes, excess spending will probably continue but energy touches everything. The price of everything should come down when the cost of energy comes down. That is what is needed. Several economists are already talking about it and warning people not to shite themselves should it play out that way.

some can be done through energy efficient products.

save some tears for us brits, we are paying $9.50 for one gallon of petrol oops gas here in the uk we are being screwed ever so tightly every day

Yes, but £2.41 ($3.05 US) of that is government 'Fuel Duty', then VAT (value added tax) of 20% is added to both that duty payment and the remainder of the pump price. So we have a tax on top of another tax. Most of what we pay per gallon goes to His Majesty's Government.

I suspect that if Americans were told that they were going to be charged as much duty / tax from next week on their gasoline as we pay, there would be riots irrespective of who was in power.

Agree wholeheartedly20% for food is BS. Our grocery bills are 2X of what they were in 2020.

Yes, it really is that simple. Currency is a medium of exchange, not a storehouse of value. Inflation is a byproduct, and “progress” is the excuse given , propagandized to be worshipped , as the fiat money supply exceeds available goods of intrinsic value. With a stable honest system there is no inflation. The closer you stand to the Fed money spigot, the lower interest rate you obtain, and the easier It is to front-run trends. The working man finds his wages never keep up and any attempt to borrow his way out of the hole leads to ruin. A form of serfdom. A 38K house in 1978 is now ” worth” 500K in a good market. It is the same old house, the intrinsic value as lodging likely diminished, with a crushing property tax bill, often leading to default, only to be snapped up by those close to the spigot. Blackrock steps in. Simple. madison Avenue sold the meme “ American dream” and we bought it. That’s your carrot. What do the big boys do ? Swap fiat for land, properties, metals, rarities, income producing assets. Simple. Oz of gold bought a sweet set of duds in Roman times, same as now. Pb is still cheap.I wish it was that simple. Around 1913 auto workers were paid about $2.50 a day, so compare that to todays dollar. What can you purchase now for a days pay?

I remember my grandfather talking about working for a Dollar a day. Of course that was many years later and I didn't comprehend what I was being told.

Typical cash has no value, it's just a convenient way of exchanging what you have for something you want. Even gold has no real value. You can't eat it or drink it, so it has a value of whatever someone else will exchange for it. Usually cash.

Inflation exists and it always will. It's part of the carrot that hangs out in front of you.

That $75,000 house from the 70's is now worth $200,000. If your investment was Ok, you can now take that inflated $200,000 and buy another inflated $200,000 house just like it. If that $75,000 cash had been "saved in a drawer somewhere, you could now buy a $75,000 house.

Leaving the gold standard was a mistake as you mention. The alternative was to have ft. Knox drained completely. Hobson choice. Temporary relief of pain with ultimate ruin baked in.CEO pay has gone from 10-30 times the amount of the average worker up to approx 300 times. I call BS on that. Another big problem is our balance sheet. Eventually, our country's financial health will hurt us as a world power, It already is in many aspects. It will take 15 years to get our balance sheet back in order, but it can be done. and leaving gold standard was huge mistake. like giving the Govt. cocaine and money printers.

Holy Smollies, after reading back through this thread I guess it’s still all Trump’s fault.

dryhumor

When an old man dies, a library is lost forever...

That’s asking a lot.The most important factor in reducing these extremes is to have a government that is stable and rational.

Ever read an annual budget put forth by the government? There’s quite a bit of irrational in it. Flip through enough pages and you be muttering to yourself oh hell no, I don’t approve of that. There’s a lot of taxpayer wealth being redistributed….

Currently we are still dealing with the chaos caused by Covid, but it's a lot better than I would have expected after having the nation largely shut down for several years.

I will always think of Covid as a bad azz flu. Yes it killed people, made them sick, some with long term consequences. But to shut down essentially the entire planet because of it. I don’t agree with that. There was more damage done from the shutdown than the bad azz flu. Had the government said “hey, this this stuff is killing people, we have vaccines, you should probably get one, don’t say we didn’t warn you…” That statement alone would probably have generated more interest than all the rest of the mandates.

Yep, and if your $500k house becomes a $38k house, that's deflation. Wasn't it in this thread where someone mentioned that oil is now no longer traded in us currency? I mentioned real estate as being the only crutch left under the dollar. Welp...Yes, it really is that simple. Currency is a medium of exchange, not a storehouse of value. Inflation is a byproduct, and “progress” is the excuse given , propagandized to be worshipped , as the fiat money supply exceeds available goods of intrinsic value. With a stable honest system there is no inflation. The closer you stand to the Fed money spigot, the lower interest rate you obtain, and the easier It is to front-run trends. The working man finds his wages never keep up and any attempt to borrow his way out of the hole leads to ruin. A form of serfdom. A 38K house in 1978 is now ” worth” 500K in a good market. It is the same old house, the intrinsic value as lodging likely diminished, with a crushing property tax bill, often leading to default, only to be snapped up by those close to the spigot. Blackrock steps in. Simple. madison Avenue sold the meme “ American dream” and we bought it. That’s your carrot. What do the big boys do ? Swap fiat for land, properties, metals, rarities, income producing assets. Simple. Oz of gold bought a sweet set of duds in Roman times, same as now. Pb is still cheap.

KMart

Gold $$ Contributor

Protecting the environment is a good thing. However, it cannot be accomplished when only North America and Western Europe are the only ones participating. WE cannot begin to offset the pollution generated by China, India, Russia and other 3rd world countries. Until the whole world is participating equally, everybody is just spinning their wheels. Don't expect China, India and Russia to get in the game and help. Therefore, we will not succeed and they will drag us down to their level.as a whole we do need to do more to protect the environment and that will only be accomplished by regulations of some sort.

some can be done through energy efficient products.

Infrequent Shooter

Gold $$ Contributor

because US was paying Saudis in gold?Leaving the gold standard was a mistake as you mention. The alternative was to have ft. Knox drained completely. Hobson choice. Temporary relief of pain with ultimate ruin baked in.

Similar threads

- Replies

- 20

- Views

- 1,061

Upgrades & Donations

This Forum's expenses are primarily paid by member contributions. You can upgrade your Forum membership in seconds. Gold and Silver members get unlimited FREE classifieds for one year. Gold members can upload custom avatars.

Click Upgrade Membership Button ABOVE to get Gold or Silver Status.

You can also donate any amount, large or small, with the button below. Include your Forum Name in the PayPal Notes field.

To DONATE by CHECK, or make a recurring donation, CLICK HERE to learn how.

Click Upgrade Membership Button ABOVE to get Gold or Silver Status.

You can also donate any amount, large or small, with the button below. Include your Forum Name in the PayPal Notes field.

To DONATE by CHECK, or make a recurring donation, CLICK HERE to learn how.